Wall Street analysts are more confident in Nike's outlook after strong earnings, improving inventory

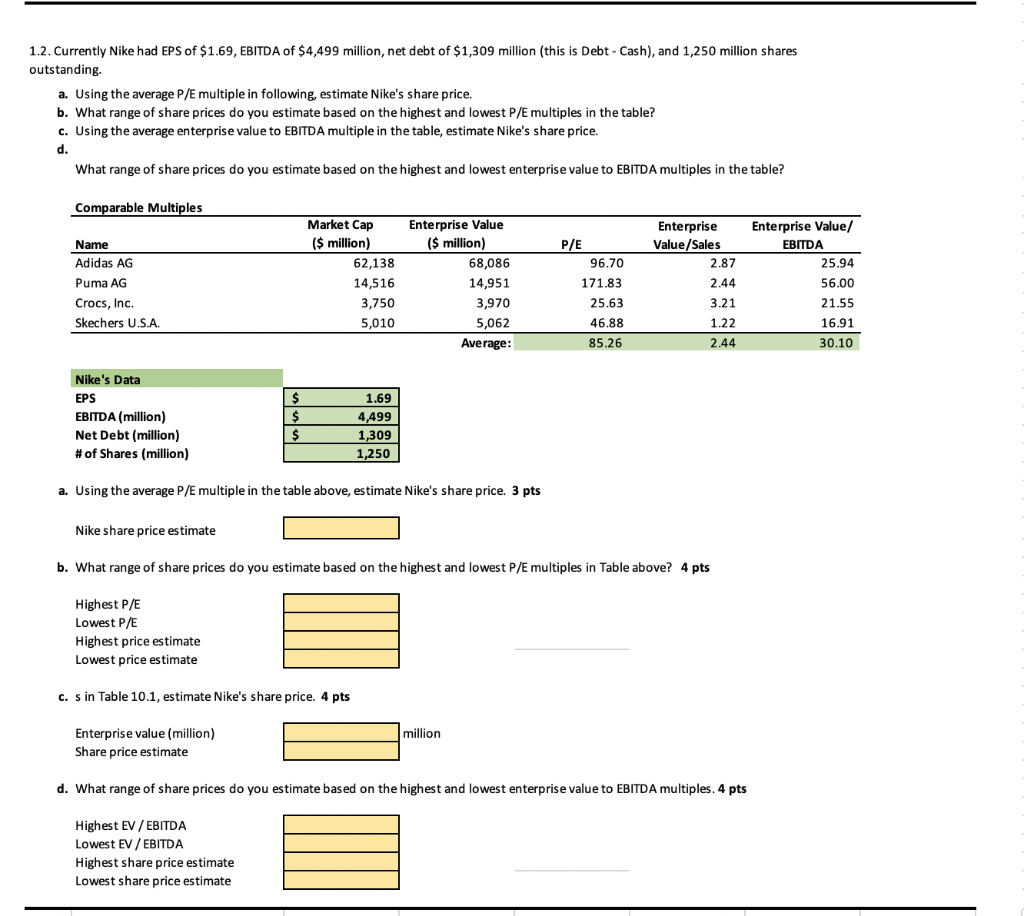

SOLVED: P 10-18 (similar to) Question Help v Suppose that in July 2013, Nike Inc. had sales of 25,308 million,EBITDA of3,261 million,excess cash of 3,338 million,S1,381 million of debt, and 892.5 million

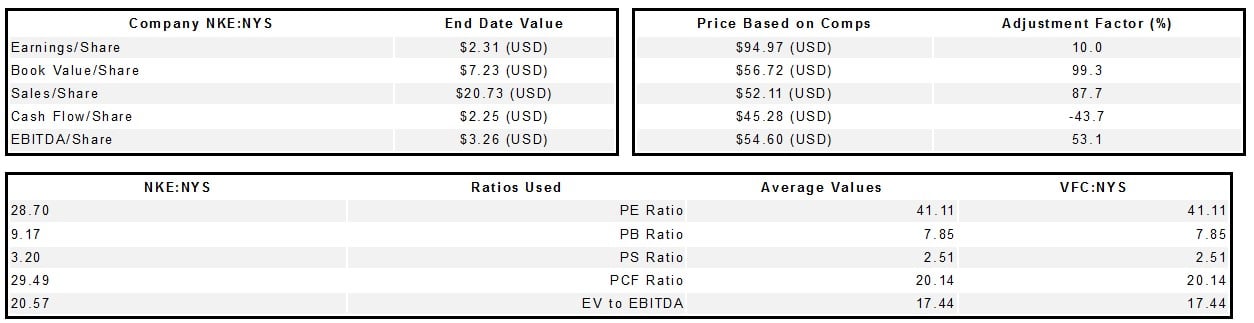

Nike Common Stock Valuation - May 24, 2010 Nike Common Stock Valuation As of May 24, 2010 By Valentyn Khokhlov, MBA. - ppt download

Problem 10-17.xlsx - Problem 10-17 Suppose that in July 2013 Nike had sales of $25 313 million EBITDA of $3 254 million excess cash of $3 337 | Course Hero

Nike Common Stock Valuation - May 24, 2010 Nike Common Stock Valuation As of May 24, 2010 By Valentyn Khokhlov, MBA. - ppt download